Mutual Funds

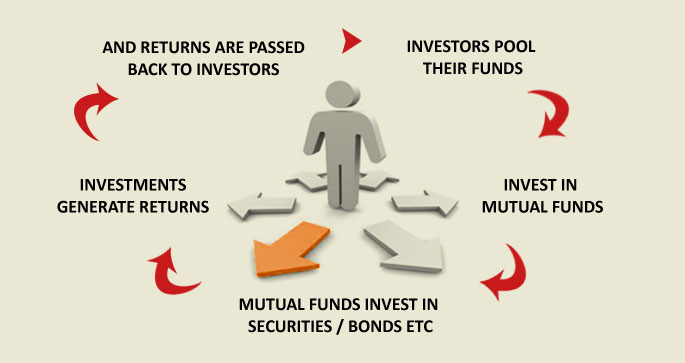

A mutual fund is an open-ended, professionally managed investment fund that aggregates money from many investors to purchase Equity and Debt Securities.

Features of a mutual fund investment

- Increased diversification: A fund diversifies by holding many securities. This diversification decreases risk and increases risk-adjusted returns.

- Professional investment management: open and closed-ended funds hire portfolio managers to supervise the fund’s management.

- Ability to participate in investments that may be available to only larger investors. For example, individual investors often find it difficult to invest directly in foreign markets.

- Service and convenience: Funds often provide services such as cheque writing.

- Government oversight: Mutual funds are regulated by governmental supervisory bodies.

- Transparency and ease of comparison: All mutual funds are required to report the same information to the investors, which makes it easier to compare the performance of the mutual funds.

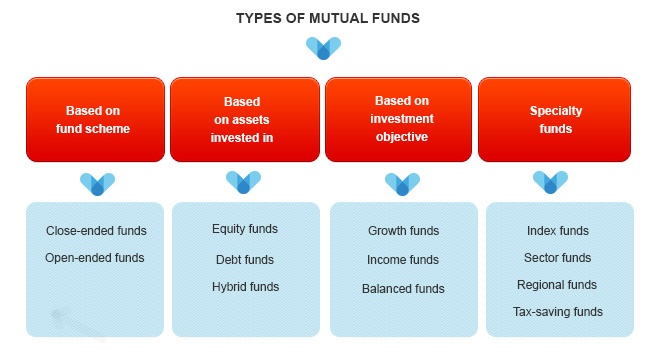

Types of Mutual Funds

Financial Planning

Financial planning is the long-term process of wisely managing your finances so you can achieve your goals and dreams, while at the same time negotiating the financial barriers that inevitably arise in every stage of life. Remember, financial planning is a process, not a product.

In general usage, a financial plan is a comprehensive evaluation of an individual’s current pay and future financial state by using current known variables to predict future income, asset values and sometimes includes a series of steps or specific goals for spending and savings for the future.

Things that come under the Financial Planning

- Risk Management

- Budget Planning & Cash Flow Management

- Investment Planning

- Tax Planning

- Children Future Planning

- Retirement Planning

- Estate Planning